Decision Theory

#004 - Wednesday 16th Aug 2023

Good afternoon.

A key topic is decision theory today and how when applied correctly can create value at scale. However, when incorrectly applied can end up costing lives.

Spotlight

Industry

Cloud Computing - The data centre business, now with a market size exceeding $250 billion, has been predominantly dominated by titans such as AWS, Google and Microsoft Yet, the market's lucrative potential and the integration of data-driven technologies across industries have now caught the attention of Tesla.

Key Developments:

Tesla's Announcement: The automaker has recently made headlines with its declaration to build “1st of its kind” data centres. The nature and specifics of what sets these data centres apart remain undisclosed.

Acquisition of Existing Infrastructure: Tesla’s decision to acquire pre-existing data centres, especially from Twitter in Sacramento, is a pretty classic example of decision-making under uncertainty. Post Musk's takeover of Twitter, a significant shift occurred in the latter's operational expenditure. Conversations are also ongoing with Prime Data Centres for a potential takeover of another facility previously used by Twitter in the same location.

Implications and Speculations:

Synergy with Tesla's Vision: Tesla’s foray into the data centre market may align with its broader mission of promoting sustainable energy. The company could be exploring innovative ways to make data centres more energy-efficient or leveraging its prowess in renewable energy sources, battery storage solutions, and cooling technologies.

Diversification and Expansion: As companies like Amazon and Google diversify their portfolios, Tesla's move into the data centre space may be a strategy to tap into new revenue streams and bolster its technological infrastructure.

Potential Competitive Edge: If Tesla can combine its expertise in energy and engineering, they might be forecasting a high probability of establishing a competitive advantage in the data centre sector, especially if they introduce groundbreaking innovations.

Tesla's foray into the data centre sector can be interpreted as a series of calculated risks and evaluations of potential outcomes. Each strategic move reflects an intricate balance of probabilities, from market capture to technological innovation. Given Tesla's history of pushing boundaries and the vast potential of the data centre market, their choices will undeniably be a focal point for analysts and industry stakeholders alike in the forthcoming months.

The Leaders Digest

What's weighing on the minds of those leading the organisations of today.

Subjective Expected Utility and Decision Theory.

When making decisions at a board level, a number of risks and biases tend to be at play, one such area of decision theory that often leaves organisations making one bad decision after another is that of Subjective Expected Utility.

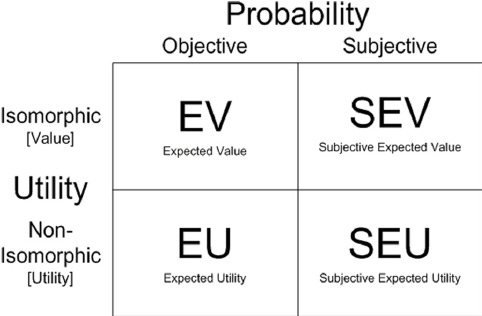

Subjective Expected Utility (SEU) represents an integrated approach to decision-making, combining probabilistic estimations with the perceived utility or desirability of potential outcomes. At its core, SEU is the product of the probability of an event occurring and the subjective utility (or value) associated with that event.

A really enlightening example of this and how troublesome it can be we can take from Aviation.

Consider Hapag-Lloyd Flight 3378 that in 2000 set off from Crete heading for Germany. The aircraft encounters a number of faults along the way and as a result is fast running out of fuel mid-flight. The pilot had ample opportunity to divert the plan to Zagreb but decided to divert to Vienna where the airline had a presence and would more easily be able to deal with the fallout of impending emergency. The pilot was a veteran of the Airline and was acutely aware of the commercial pressures of minimising delays and maintenance costs to the airline.

The decisions the pilot took were subjective and not objective and had dire consequences.

Vienna: The probability of making it to Vienna from the pilots perspective was 100%, and the subjective value assigned to landing there is 10/10, representing his awareness for the airlines presence at Vienna and how much he would prefer this option. Hence, the SEU is 1000 (100% x 10).

Zagreb: Similarly, the probability of landing in Zagreb was also 100%, given the fact they flew right over it, but the subjective value of landing there is perceived to be half that of Vienna at 5/10. This results in an SEU of 500 (100% x 5).

In the captains mind, going to Vienna was clearly the right choice based on their mental model. In this situation at no point did the captain carry out an objective analysis of the true chances of making to Vienna and their thinking was further clouded by another area of decision theory - planned continuation bias (which is pretty self explanatory). Under the conditions and stresses laid upon the Captain, their familiarity with the existing plan, however objectively unachievable it was, was worth more to them than the alternative.

It’s easy to see how this cascade of thinking can lead someone to an undesirable or on this instance, an unsafe outcome.

But these sorts of decisions happen all the time in business.

SEU, when misinterpreted or improperly applied, can negatively impact board-level decisions. Here's why:

Subjectivity can skew perspectives: Large capital projects or transformations are typically multifaceted. The subjective utility assigned by different stakeholders might vary, leading to biased perspectives. For instance, a board member with a personal inclination towards a particular project might attribute a higher utility to it than its actual organisational value.

Over-optimism and Confirmation Bias: If board members are overly optimistic about the outcomes of a project, they might overestimate the probabilities, leading to an inflated SEU. This becomes perilous, especially when the stakes are high.

Dynamics of Group Decision-Making: Board decisions are collective. Differences in subjective utilities among board members can create conflicts or lead to decisions that serve the interest of a vocal few, rather than the broader organisation.

That said, SEU is not entirely doomed. Applied in the correct setting with the right parameters and objectives and it can be highly successful.

Amazon's Product Recommendations

Contrastingly, when applied in certain operational contexts, SEU can be extremely potent. Consider Amazon's product recommendation engine:

Data-Driven Probabilities: Amazon estimates the likelihood of a product being purchased by a user based on historical data and browsing patterns. This provides an objective probability.

Utility Valuation is Clear: Amazon assigns utility based on potential revenue generation from a product. The integration of this clear utility metric with purchase probability guides the recommendation engine.

Scalability: For digital giants like Amazon, SEU allows for scalability. The method can be applied to millions of products and billions of users simultaneously, optimising revenue streams in real-time.

The success of SEU is entirely contingent on the context. While it can drive precision and scalability in algorithmic contexts like Amazon's, it requires a discerning approach at the board level, ensuring that subjectivity does not cloud judgment or lead to decision-making pitfalls.

The key takeaway for business leaders is to understand SEU's strengths and limitations and to ensure that its application is tailored to the intricacies of the specific decision-making scenario at hand.

Latest Insights

The Nadella Effect: Turnaround strategies for laggard leaders.

Read here

For deeper industry reads be sure to subscribe to Special Reports below.

The Nugget

A very visually strong alternative to the likes of i-stock and unsplash. For retail brands and those selling via e-commerce platforms, art direction has been a key driver for engagement and carefully curated imagery is closely correlated with interrupting the habitual scrolling of users, leading to better sign-up rates and increased conversions.

How can we help you?

Get in touch with our strategy practice.

See you next Wednesday.

// N

P.s. Don’t forget to check out The Nadella Effect, a deep dive into the strategies and frameworks used at Microsoft in one of the most successful turnarounds in corporate history.